How To Read A Bond Quote Like A Professional Bond Trader

Post on: 4 Март, 2017 No Comment

Bond Quotes As A Percentage Of Face Value

Most bonds are sold in $1,000 denominations. If you buy 20 bonds, you are buying bonds with a face value at maturity of $20,000. For a variety of reasons, bonds trade at a discount or premium to their face value .

You would expect a bond that has a $15 premium to its face value would be quoted at $1,015.00 when you tried to buy it. This is generally not the case. Instead, the bond would be quoted as 101.500 or 101 ½.

Bonds are generally quoted as percentage of face value. For example, a bond selling at 980 would be selling at 98% of its face value – and would therefore be quoted at 98. However, there are different conventions used to describe percentages less than 1 percent. The remainder can be stated as a decimal which is fairly easy to understand. A bond selling at 101.125 would have cost $1011.25 to buy.

However, the remainder can also be expressed as a fraction. For example, Treasury Bonds are usually expressed in 32nds. The price of the bond could be expressed as 101 ⅛ or 101:4 (its assumed 4/32nds)

Bond Quotes Expressed In Terms Of Yield

What does it mean when the anchor on CNBC says, “The 2 year US Treasury jumped 8 basis to 2.12% yield ”? Here is a breakdown:

“2 year Treasury” Describes the bond being traded.

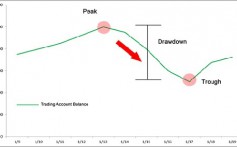

“Jumped 8 Basis Points” — In bond speak, a point is equal to one percent. A basis point is 1/100th or 0.01 percent. With bonds, price and yield have an inverse relationship. So an increase in yield means the price of the bond dropped.

“2.12% yield” The 2.12% is the yield to maturity based on the current market price. By talking about yield instead of price, its easier to compare different bonds. Yield takes into account both coupon rate of the bond and the market price. As bonds have different coupon rates, just looking at the percentage change in price would be misleading gauge of buyer’s potential return on the bond. A one percent price move for a bond with a low interest rate is far more significant than a one percent price move for a bond with a high interest rate.

Bond Quotes Expressed As A Spread Against Treasuries

Professional traders of corporate bonds often talk about price in terms of the difference between the bond’s yield and the yield of a treasury with a comparable maturity. If a professional trader is offering a corporate bond to another trader at “+175” and the yield of the comparable treasury is 2.00%, the yield on the corporate bond would be 3.75%.

Want to learn how to generate more income from your portfolio so you can live better? Get our free guide to income investing here .