RecessionProofing An Investment Portfolio Financial Professional Highlights Advice Investors

Post on: 9 Март, 2017 No Comment

The average individual investor holds portfolios comprised of stocks, bonds and cash. Today that places many investors in a quandary: while bonds are often a safe haven when the stock market outlook is uncertain, bonds usually do not do well when inflation increases, precisely the economic conditions we now face. According to David Kaiser, a Denver-based independent financial professional, investors would be smart to look at where institutional investors, like foundations and trusts, turn during times of market volatility.

The silver lining in a depressed housing market for high-net worth individuals is that lower prices could spell opportunity

Denver, CO (PRWEB) May 27, 2008

The average individual investor holds portfolios comprised of stocks, bonds and cash. Today that places many investors in a quandary: while bonds are often a safe haven when the stock market outlook is uncertain, bonds usually do not do well when inflation increases, precisely the economic conditions we now face. According to David Kaiser, a Denver-based independent financial professional, investors would be smart to look at where institutional investors, like foundations and trusts, turn during times of market volatility.

Kaiser believes there are several things a individual investor can do, but the first and most important is to control emotions. Unlike institutional investors, individual investors tend to panic and end up selling when they should be buying, says Kaiser. By following three tips, individual investors can keep their heads on straight and likely come out of a down market relatively unscathed.

Buy Global

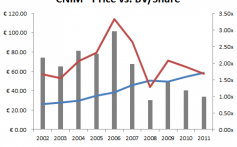

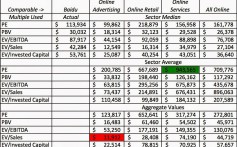

One place institutional money managers are investing is overseas. World stock markets extended their winning streak in 2007, outperforming the U.S. for the fifth year in a row, thanks primarily to huge increases in emerging markets and a weakening U.S. dollar. For example, the Dow Jones World Stock Index, excluding the U.S. increased almost 12% in 2007 (in U.S. dollars) compared with a gain of 6.4% for the Dow Jones Industrial Average. The hottest performers were in developing markets. Benchmark indexes in China, India, Turkey, Indonesia and Brazil all rose by more than 40%.

Another investment possibility given a devalued U.S. dollar is buying stock in large U.S.-based multinational companies as an alternative to foreign stock. Most of these stocks have appreciated as much as many foreign stocks, and although they could go down in value, the companys global dominance could possibly cushion the blow.

Buying foreign government bonds is another possible hedge in an environment with a weak U.S. dollar. Investing in overseas government bonds is based on the health of economies and not corporations. Foreign government bonds are unlikely to fall as hard as stocks in difficult times, says Kaiser. Another way investors can help protect their portfolio from inflation is to invest in Treasury Inflation-Protected Securities, whose principal rises with the consumer price index. Investors might also be wise to allocate some funds into gold-related investments in the event that the price of oil continues to increase and inflation continues to rise.

Get Real With Investments

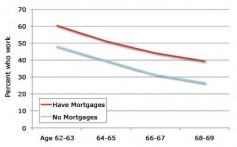

Its no longer news that the real estate market is suffering badly, says Kaiser. But it may be good for high net worth individuals. In 2007, new home sales were down 34%. Since peaking in June of 2006, house prices have fallen 6.5% as of October 2007, according to the S&P/Case-Shiller Home Price Index, which measures home values in 20 cities. David Mudd, Chief Executive of government-sponsored mortgage investor Fannie Mae, expects prices to decline another 4-to-5% in 2008. The silver lining in a depressed housing market for high-net worth individuals is that lower prices could spell opportunity, says Kaiser. There are bargains to be found out there and now might be a good time to buy a second home or rental property. Rental income is generally believed to have some inflation-protection potential because as leases expire rents can increase.

Emotions Hurt Investment Results

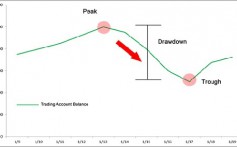

When stocks plunge, many investors make mental mistakes, says Kaiser. Individual investors often take the markets decline and extrapolate into the future. Investors worry over loses even though the Dow Industrials are still up 79% since 2002s market low. Confidence often ebbs away and they grow increasing risk-adverse. Investing in a long-term process involves some degree of risk. Every investor should determine the trade-off between risk and reward. The higher an investments potential return, the greater the risk will usually be.

Many individual investors, usually not institutional investors, overreact to information whether it is good or bad. This trend is often on the negative side and therefore, many investors decide to sell even though the price of the stock is already down, then they compound the problem by buying into low-yield safe-haven investments.

Do not panic in times like these and remember to look at the long run, advises Kaiser. The NASDAQ composite index was up 9.8% for 2007, despite a 1.8% decline in the fourth quarter. If you missed the four best days of the NASDAQ in 2007, your return falls to 2.3% loss for the year. If you avoided the four worst days of the NASDAQ in 2007, your total return would have been up 23.7% according to BTN Research.

Although I am concerned about the health of the economy, I have confidence that American businesses will excel, says Kaiser. There are many incentives built into our capitalist system that will help the economy grow. Betting against the U.S. economy has been a losing bet over the long term.

What if the gloom about the economy turns out to be false? This would not be the first time that has happened. In 1995, unemployment spiked, job growth turned negative, and the factory sector fell into a year-long recession. Broader economic growth nearly came to a screeching halt, but then rebounded and soared until the decades end. That pattern also describes the mid-1960s and the mid-1980s. The volatility of the past year should strengthen our need for financial strategies and reinforce the importance of planning.

###

PDF Print