Understanding Your Mutual Funds Portfolios US News

Post on: 6 Декабрь, 2016 No Comment

Lessons from one popular mutual fund’s wild ride.

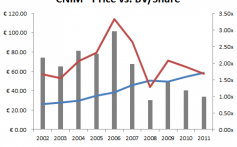

For a long time, it seemed that the Fairholme Fund was infallible. From 2002 through 2010, veteran manager Bruce Berkowitz beat the S&P 500 every year except for one. In four of those years, the fund outpaced the index by a double-digit margin. Even in the fund’s one off year, 2003, it still gained almost 24 percent.

But in 2011, the walls came crashing down. While the broader market finished the year in the black, Fairholme lost a whopping 32 percent. The reason for this horrendous performance is the fund’s heavy exposure to financial companies.

For many mutual fund investors, Fairholme’s 2011 performance came as a shock. Fairholme Capital Management’s motto, displayed right at the top of the fund’s prospectus, is: Ignore the crowd. But ironically, many investors in the fund had done just the opposite: They had followed the crowd into the fund. Lured in by Berkowitz’s seemingly uncanny performance, they invested without doing their homework.

This year, the fund has mounted a comeback. From the beginning of 2012 through the end of the second quarter, it was up nearly 25 percent. The fund is succeeding this year for the same reason it floundered last year. Insurance conglomerate AIG accounts for nearly a third of the fund’s portfolio. After losing more than 50 percent last year, the company has seen glowing returns in 2012.

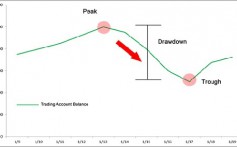

At the moment, evaluating Fairholme’s performance is an exercise in where you fix the camera lens. The fund’s trailing 10-year returns are still stellar. Indeed, as of July 27, those returns outpaced those of the S&P 500 by an average of 2.45 percentage points per year. But its trailing three-year returns land it in the bottom 1 percent of Morningstar’s large-value category.

So what’s the lesson? First and foremost, understand a fund’s portfolio before investing. Fairholme, for instance, is a highly concentrated fund. As of the end of February, more than 90 percent of its portfolio was invested in just 10 holdings. As of the same time, more than three-quarters of its stock holdings were in financial companies.

Sound risky? It is. Morningstar’s Russel Kinnel recently offered the following advice regarding Fairholme: [T]he portfolio is still quite aggressive in that it owns some highly concentrated deep-value plays. Smooth sailing now doesn’t mean forever. It is still a good fund but only if you plan to hold for 10 years or more.

Before investing in any fund, there are a number of characteristics to consider. First, how concentrated is the portfolio? The more holdings a fund has, the lower the chance is that one bad bet will sour an entire portfolio. At the same time, however, sometimes the higher the risk, the higher the reward. Funds that have too many holdings run the risk of consistently seeing mediocre returns. In other words, concentrated portfolios aren’t inherently a good or a bad thing. But before investing in a heavily concentrated fund, it’s important to understand the potential risks and benefits.

Another thing to look at is sector allocation. Sometimes that will be obvious from the fund’s name. For instance, it should come as no surprise that the Davis Financial Fund (RPFGX) is heavily invested in financial companies. For other funds, such as Fairholme, it takes more digging.

In doing this, try to get a sense of what to expect from the fund. In what market scenarios will it perform well? What types of events would cause it to struggle? This will help you with one of the key goals of smart investing: diversification. For instance, if you have a fund that could stumble if financial companies struggle, do you also have holdings that will remain unaffected by—or maybe that would benefit from—that eventuality?

Investors who thought that Fairholme was the magic bullet were clearly wrong. But then again, no single fund ever is.