Real Estate in the Energy Capital of the World

Post on: 6 Февраль, 2017 No Comment

Much has been made of the dramatic movements in oil prices and the potential effects both domestically and internationally. Here, we narrow in on oil’s impact on Houston, the self-proclaimed “Energy Capital of the World” and, specifically, on real estate in Houston.

The crude oil price collapse of 1986—where prices fell 58% in just over seven months—devastated the Houston economy. The negative impact was magnified by the “double-whammy” that included massive over-building in the oil patch triggering the Savings & Loan crisis. It took nearly ten years for Houston to recover.

In more recent years, Texas led the charge coming out of the Great Financial Crisis in large part due to its ties to the energy sector, creating 25% of all net new jobs in the U.S. since 2009. Houston, specifically, boasts a 4.1% unemployment rate (as of 12/2014), well below the 5.6% national average. 1 The addition of healthcare and higher education sectors has made for a more diversified local economy, yet Houston remains heavily energy-dependent. Although nearly half of the figure from the 1980s, roughly 38% of Houston’s economy is tied directly to energy. 2

Real Estate Houses Houston’s Economy

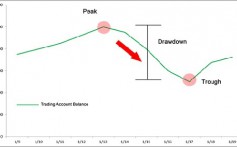

And the mood in Houston has changed. Houston’s real estate “houses” its economy; there is a clear connection between the energy sector boom and real estate market strength. With oil prices now down by over 50% since July 2014, a cloud is hanging over the metro’s real estate markets, as much because of uncertainty associated with oil price volatility as the actual drop itself. Until prices stabilize, both buyers and lenders will perceive the Houston market as a riskier trade, which will lead to higher return requirements and lower prices. Many firms are hitting the pause button on moves and expansions, especially in Houston’s Central Business District (“CBD”) and the Energy Corridor. Moreover, media reaction to the oil price decline has been intense and is influencing the tone of landlord/tenant conversations. Near-term this will negatively impact rents, perhaps in the range of 5% to 10%.

Submarket Exposure to Energy is Key

Within the Houston metro, the submarkets differ in their exposure to energy. For example, office tenancy in the Galleria submarket is only 34% directly linked to energy, compared to 50% and 80% of office tenants in the CBD and Energy Corridor, respectively. 3 As such, markets like the Galleria will be cushioned by its diverse tenancy and will fare better in a downturn than others.

Looking Forward

The ultimate impact of cheaper oil on the Houston economy and its real estate markets depends largely upon two things: 1) How low will oil prices go? and 2) How long will they stay there? Should lower oil prices persist, it is expected that merger and acquisition activity will increase. This will likely result in more layoffs from redundancies and consolidation of space, dampening the demand for space. And, especially when mixed with the spate of new construction, this, in turn, should lead to a decrease in rents as landlords scramble to attract and retain tenants.

Houston’s diversified economy, pro-business government and tax structure, and entrepreneurial culture will help the city continue to grow. On the other hand, if lower oil prices persist, they will dampen that growth such that it will feel as though Houston is in recession. This will put the brakes on new development projects in the pipeline and also slow down the lease-up of recently completed projects and properties currently under-construction.

It would be highly speculative to attempt to divine an immediate impact. Hard data for evaluating the current environment is scant, as it takes time for completed transactions to substantiate market movement. Anecdotes on buyer “re-trades” point to slightly higher capitalization rates and modestly lower prices across property sectors. The magnitude of these moves is heavily dependent upon asset-specific factors like location, quality and tenancy. Only once oil prices settle will it be possible to make well-reasoned forecasts on either the near-term or medium-term impact to Houston’s real estate market.

1 Bureau of Labor Statistics.

2 Greater Houston Partnership based upon U.S. Bureau of Economic Analysis Statistics.

This communication is for informational purposes only and is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy or investment product. This communication does not take into account the particular investment objectives, financial situations or needs of individual clients. References to specific stocks are for illustrative purposes only and are not intended to represent any past, present or future investment recommendations. Charts and performance information provided in this presentation are not indicative of the past or future performance of any Bailard product, strategy or account. All investments have the risk of loss. In addition to the normal risks associated with investing, international investments in a single country may involve risk of capital loss from fluctuations in currency values, from differences in generally accepted accounting principles, from country specific risks and from economic or political instability in other nations. Emerging markets involve heightened risk related to the same factors, as well as increased volatility and lower trading volume. There is no assurance that Bailard or any of its investment strategies can achieve their investment objectives. Past performance is no guarantee of future results. This communication contains the current opinion of its author and such opinions are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. Bailard cannot provide investment advice in any jurisdiction where it is prohibited from doing so.